|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home Improvement Loan: A Comprehensive GuideRefinancing a home improvement loan can be a strategic move to enhance your financial situation. By understanding the process, benefits, and potential drawbacks, you can make informed decisions that align with your goals. Understanding Home Improvement Loan RefinancingRefinancing involves replacing your existing loan with a new one, usually with better terms. This can lower your monthly payments, reduce your interest rate, or provide additional funds for further improvements. Benefits of Refinancing

Potential DrawbacksWhile refinancing offers several benefits, it's important to be aware of potential downsides. These include closing costs, possible longer loan terms, and the risk of increasing total interest paid over the life of the loan. Steps to Refinance Your Home Improvement Loan

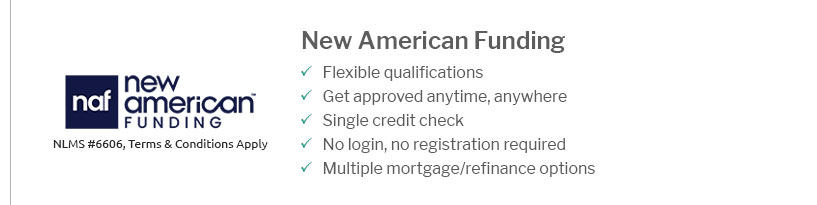

For an accurate estimate of potential savings, use the us mortgage refinance calculator. FAQ SectionWhat is the best time to refinance a home improvement loan?The best time to refinance is when interest rates are lower than your current rate, and your credit score has improved. This can help maximize your savings. Can I refinance if my home value has decreased?Yes, you can still refinance, but options may be limited. Consider a loan program that caters to homeowners with decreased property values. How do closing costs impact refinancing decisions?Closing costs can be substantial, so it's essential to calculate whether the savings from refinancing outweigh these costs. Sometimes, these can be rolled into the new loan. https://www.newamericanfunding.com/refinance/improve-my-home/

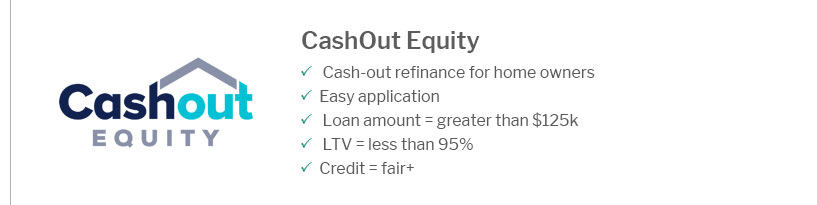

Fortunately, there are financing options to help fund your home improvements, such as a Cash-Out Refinance and a Home Equity Line of Credit (HELOC). Both ... https://www.freedommortgage.com/learning-center/articles/home-improvement-refinance

A cash out refinance can be a great way to use your home's equity to pay for home improvements and repairs. https://www.kennebunksavings.com/resources/home-renovation-refinancing-vs-a-home-equity-loan/

Now the big question: how do you pay for it The most common ways to finance home improvements are: (1) to refinance your home and use the cash out to pay for ...

|

|---|